- 1. Easy payment (https://pay.mts.ru/webportal/payments)

- 3. Payment through Sberbank Online (https://online.sberbank.ru/CSAFront/index.do)

- Part 1. We collect the necessary data (if you know the details for payment - go to part number 2)

- Online

- Payment through the terminal

- Loan from another bank

The history of the bank began back in 2002. Although it became “MTS-Bank” later, in 2012. It all began with the brand “Moscow Bank for Reconstruction and Development”, which became popular among the masses thanks to lending individuals . Today it has become recognizable, thanks to the rebranding and its introduction to the overall style of services Comstar Direct (MTS Mobile Communications, Internet Stream). Credit rates do not bite, the number of ATMs and service offices cover a comfortable service area for the entire city of Syktyvkar. MTS-Bank has its own Internet banking and mobile office (application for Windows phone a miracle as well). In addition to ATMs and MTS stores, you can pay for a loan on the Internet. But then there are small problems. Internet banking allows you to transfer funds only between your accounts. "Repayment of loans", as indicated on the description page, is not there, as such. Unless, of course, you do not have a MTS-Bank salary card, which is unlikely. In the Web-money to repay the loan also does not work - there is no such item. I had to look for alternative ways. I was told to write this article, the fact that in the city of Syktyvkar all ATMs refused to work with cash, and in the salons of communications they referred to problems with software . At one time I took a loan for a trip to Italy and now it's time to repay debts. A visa to Italy cost at that time a little more than 5,000 rubles and was made 2 weeks (Schengen). If you decide to do it, please note that 2-ndfl is not suitable for an Italian visa - you need a special reference on the model, and the passport must be valid for more than three months.

1. Easy payment (https://pay.mts.ru/webportal/payments)

Pros : Instant Arrival

Cons : You can not pay with a credit card.

With the help of the pay.mts.ru service, you can pay a loan in just three clicks, but there’s no way - to deposit money into the account, only the mobile account of the subscriber connected to the MTS is used. Those. if you use another operator mobile communications This method does not suit you.

Owners of "plastic" bummer:

2. Rapida Online (https://pps.rapida.ru/)

Pros: Quick registration in the system, payment is literally three clicks.

Cons: A small commission, the inability to replenish a personal wallet from a bank card without identification (personification)

3. Payment through Sberbank Online (https://online.sberbank.ru/CSAFront/index.do)

Pros : Available to every VISA owner from Sberbank. You can make a template and pay for it in 2 minutes.

Cons : Payment will arrive in 1-3 business days.

Part 1. We collect the necessary data (if you know the details for payment - go to part number 2)

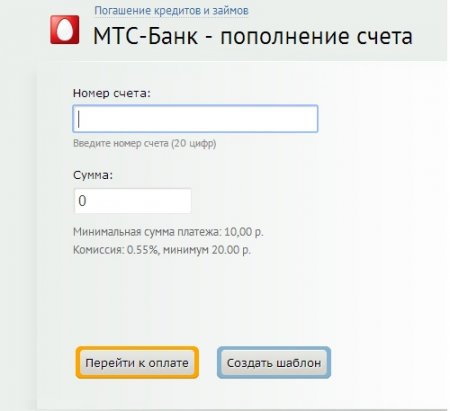

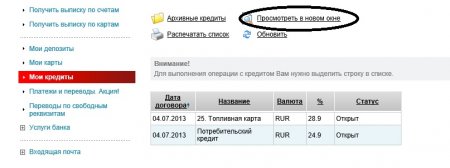

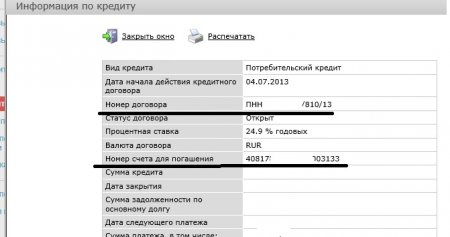

You can pay through this service, in principle, any loan. Only bank details are required. Also, we will definitely need the account number and contract number . If there is no agreement on the hands, they can be recognized through MTS Internet banking . It does not work correctly in the Google Chrome browser. Better use Internet Explorer. Having entered the login and password, go to the page "My Credits" . Next, select desired string and click "View in new window". And there we will see the necessary data:

If you have forgotten your login and password to enter the service, then you can restore it at any ATM of MTS Bank:

Login and password for IB printed on the check:

If you already paid earlier loan through an ATM, the account number can be seen there:

Operational check:

Need a loan at 5%, 10% or 20% per annum? Find out the overpayment through the calculator!

Sberbank of Russia is a large and very popular organization, in which there are many depositors, payroll and loan clients . Of course, the bank offers many options for paying loans: this can be done via the Internet, at a bank branch, and with the help of numerous terminals. Let us consider how to pay the loan through Sberbank, in more detail.

- The most convenient way is to pay the loan through Sberbank Online.

- Sberbank has many terminals with bill acceptors through which it is convenient to make payments.

- Through Sberbank Online, you can pay a loan of any bank if you know its BIC and the loan repayment account specified in the contract.

Online

If you have access to your Sberbank Online account, then there will be no problem with making monthly payments via the Internet. In the “Credits” section you can choose the necessary one (if there are several), immediately find out the balance for full repayment , as well as the size and date of the mandatory contribution.

Further, you need to select a card or account (they are also registered in your personal account) from which funds will be deducted. After you enter the transfer amount, you only need to confirm the transaction.

You can make such transfers systematic by specifying the time interval through which they need to be made (for example, once a month).

To be able to pay the loan through Sberbank Online, you need to activate the service “ Mobile Bank "Because for security you have to enter the code. It is sent in SMS and is needed to confirm financial transactions.

Payment through the terminal

Sberbank of Russia has its own terminals, and in addition, there are many terminals different companies and many have the option of paying a loan.

What is a terminal and how does it differ from an ATM? There is a card slot in the ATM and there may be no bill acceptor. In the terminal, the bill acceptor is the main element.

In the terminal menu, select “Payment of credits” (it may be called differently depending on the type of terminal), and then follow the instructions written on the screen. You must know the loan repayment account number specified in the contract.

If difficulties arise, for the first time it is best to come to the Sberbank branch and ask a specialist to help deal with the operation of such a terminal.

If you decide to use a terminal that is not related to the Sberbank network, pay attention to the commissions, as they may result in an amount less than obligatory payment . As a result, there will be fines, and your reputation as a borrower will be impaired.

Loan from another bank

Indeed, it is possible to pay a loan through Sberbank third party bank . Such a function is in the personal office of Sberbank Online, and in addition, it can be done in the branch.

Entering your personal account, you need to find the “Payments and transfers” menu item. There is a sub-item "Payment of a loan from another bank." For the correct execution of the operation, a BIC (bank identification code a) the organization in which the loan is issued, as well as the loan repayment account number. All this is in loan agreement therefore it is better not to lose it.

MTS Bank loan recipients are often interested in how to pay it on time. There are several ways to do this: with and without a commission, with instant crediting and the next day. The information you need is in this article.

This organization supports several methods of repaying consumer credit and credit card debt, most of which are easily accessible. Choose the one that best suits you, but first read the article on how best to pay it off.

Next, we offer you a list of opportunities that MTS Bank provides to its customers for the timely payment of debt. Please note that some of them imply the presence of additional fee for this service.

Where can I pay:

- In the offices of MTS Bank. Come to the offices and transfer money to the account at the box office. This is the most profitable way repayment, because for this operation you will not be charged a commission. You need a passport and account number, transfer occurs instantly;

- In stores MTS . You will need a passport and a contract, or rather your number credit account . A commission of 1% of the size of the payment will be charged, but not less than 50 rubles. In this case, the money will be credited up to 3 working days;

- Cashier in stores MVideo, Eldorado, Technosila . You will need to pay a fee of 1% (min. 50 rubles.), Enroll the money no later than the next business day. It will be necessary to name the account number, full name of the borrower, sometimes it is required contact number telephone;

- Terminals of networks, CyberPlat, Today transfer will take place, individual commission from 1 to 1.3% (minimum 50 rubles). You need to know the number of the contract or account. These terminals are spread throughout the country, so you don’t have to search for them for long;

- Electronic money and payment systems: Yandex.Money, Rapida, gold Crown . If you use these systems, it may be convenient for you to repay the loan in this way;

- Transfer of funds from a bank account to your current account intended for payment credit debt . Same as payment by credit card . You will be able to make a transfer through your Personal Account in Internet banking with payroll or any other debit card issued in MTS Bank. In this case, you need to know the details of the recipient, find out the rates in the company where you make the transfer. The term can be up to 2-4 business days.

Here are ways that will suit almost everyone. You will find even more information on the official website of the company at the link mtsbank.ru/personal/remote/howpay/c-credit/. If you need Additional Information , you can get it by phone hot line Bank - 8 800 250-0-520.

Before you pay the loan of MTS Bank, you need to find out what commissions are charged in order not to overpay the excess

Early age and lack of commitment - lower chance to get a loan.

Have credit organizations There are preferences in choosing customers. Most agree that the ideal client is a Russian citizen of 25-55 years old, who has a spouse and two children. If you are 18, your chances, unfortunately, are sharply reduced, and some banks generally consider borrowers only from 23-25 years old. But if you are 35 and you have no family, you are not an interesting candidate either, your application will be considered very meticulously.

Fast consideration of the application - exaggerated interest rates .

It is not surprising that for a quick review of your application you will receive a loan at a fairly high interest rate, reaching 70 percent per annum. Everything is easily explained, because the banker deliberately takes the risk without properly checking the borrower. For such untested and unsecured loans from banks, high overdue payments and defaults. On the shoulders of a respectable customer and these losses fall.

More information about you - higher chance to get a loan.

Bankers love it when they know all about the client. When there are several work phones, when there are several contact persons when the maximum number of documents is attached when there is a large number of information about your property. In a word, the more information you provide about yourself, the higher the chance of getting a loan.

Refusal in one bank does not mean refusal in another.

Each bank has its own requirements for borrowers. Some bank agrees to clients only without delinquency, another is ready to issue even current delinquency . Some banks have a salary requirement of at least 7 thousand rubles, the other has at least 20. If you need a loan, select a bank according to your conditions.

Small amount - higher probability of a positive decision.

Bankers are afraid to give unverified customers. large amounts of money. If you want to get a loan in this bank, so as not to get a refusal in that amount, first take the amount less. Redeem it and contact the bank again, your chances of getting, say 1.5 million rubles, will increase by 90 percent than when you first applied.

Salary card - the most best deals at interest rates.

If you need a loan, first consider the option of receiving it in the same bank where you receive wages . Availability payroll card reduces interest rates on loans sometimes by 10 percent. If for new clients the rate is 25 percent, then for salary workers - 15. If you receive a refusal, it is never too late to contact another bank.

Preliminary positive decision - does not guarantee the receipt of the loan.

Sometimes sending a loan application, you get a message to the phone with the text: "A preliminary positive decision has been made on your loan application." Unfortunately, this decision does not mean that you get a loan. Many banks online applications only weed out unwanted borrowers.

Life insurance is optional.

Often credit specialist tells you that in order to increase the likelihood of you getting a loan, you need to get life insurance and work capacity insurance. But this is not the case. If the bank makes a decision regarding you, insurance is not important to it. The credit specialist himself receives his premium for processing insurance, therefore he is interested in it.

Negative credit history - do not always wait for failure.

If you had a delay on previous loans and loans, then you have a negative credit history. If you still paid them, then its quality is set at the average level. Most banks are willing to lend to borrowers with a tainted credit history if you have one, do not always wait for your request to be rejected.

Less references - more interest.

Today, many banks do not require the provision of income statement when obtaining a loan. For many, this is a plus. However, interest on such offers is always a level higher. If you have the opportunity to get a certificate from work, pick up a loan for yourself with the provision of documents confirming income.

What is a terminal and how does it differ from an ATM?